Our Mission

At Linde, we are united behind our commitment to safety, integrity, community, inclusion, and accountability in all we do. We live our mission of making our world more productive every day.

Understand Our Commitment >

Decarbonize with Hydrogen

Investing in the future is key to Linde's focus for a greener world driven by the power of hydrogen.

Fueling the future >

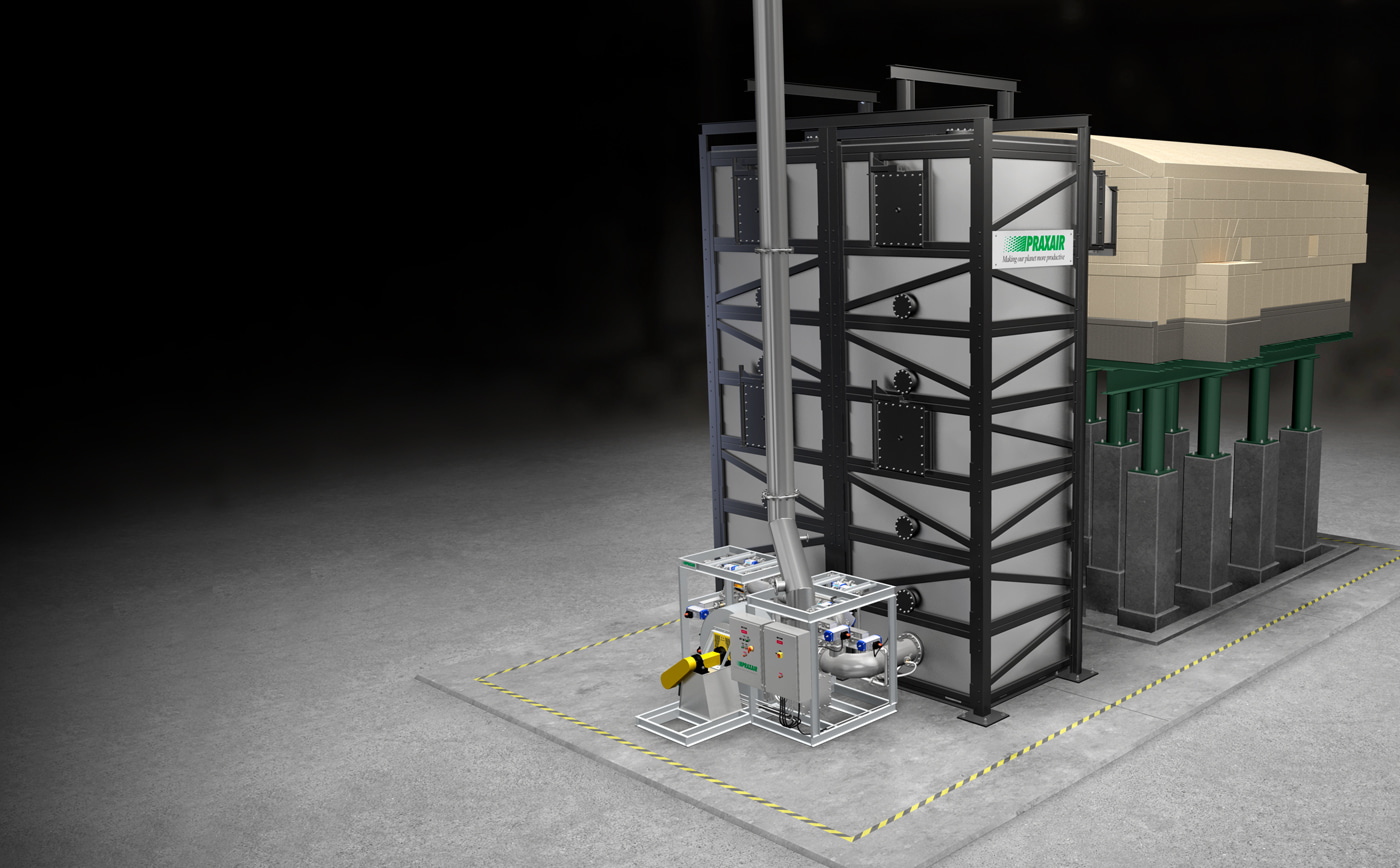

Clearly Productive

Increase the energy efficiency of your glass furnace and reduce operating expenses with Linde's OPTIMELTTM Thermochemical Regenerator system.

See more >

There's Something New in the Air

We provide atmospheric gases produced using 100% zero-carbon energy sources. This provides our customers with the opportunity to help reduce carbon footprint.

The Linde Green Option >

Fusing Productivity & Affordability

Our Stargon™ SS blend for MIG welding stainless steel is a carefully controlled blend of Ar, CO2 and N2 that helps you improve deposition rates, weldability and color matching, while helping you to reduce your costs.

Learn more >